For over 30 years, I’ve watched people agonize over whether or not to switch their beverage supplier. About half of that time, I was on the beverage company side, trying to convince restaurant operators to stay with or switch to Coca-Cola. The other half of that time, I was either making the decision on behalf of a chain I was leading or advising a client who had to make the decision.

It is now clear to me that the choice of a cola supplier will affect some things, but not the things that most people agonize over. The misplaced consternation is a common problem. In this article, we examine some misconceptions and reveal some rarely talked-about truths.

First, the misconceptions . . .

#1: If I switch, my beverage sales will go down (or, conversely, go up)

No. Simply, no. In over 30 years of doing this I have never seen a case where beverage sales declined (or went up, for that matter) because a restaurant chain simply switched cola brands. It’s even more true now. Why? For two big reasons….

1. Cola is a declining segment within a declining segment.

It is an ever-shrinking part of the beverage mix. The portfolio of products is more important than the cola. And people will drink something in your portfolio of beverages with their meal.

It makes sense now to think of your beverage supplier not as a cola brand, but a manufacturer of a variety of consumer-preferred beverages that go with your food. It also makes sense to examine a variety of packages, not just fountain.

Consider the facts:

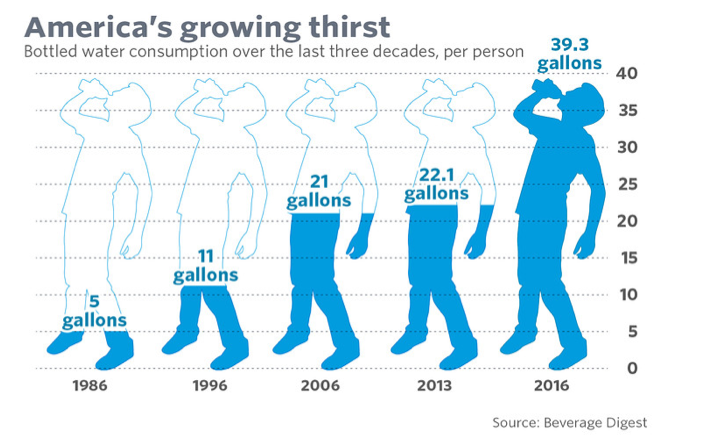

According to Beverage Digest, in 1986, per capita bottled water consumption was about 5 gallons. In 2016, that number had risen 39.3 gallons. That’s a massive jump that no other beverage saw over the same

Data Source: Beverage Daily.com

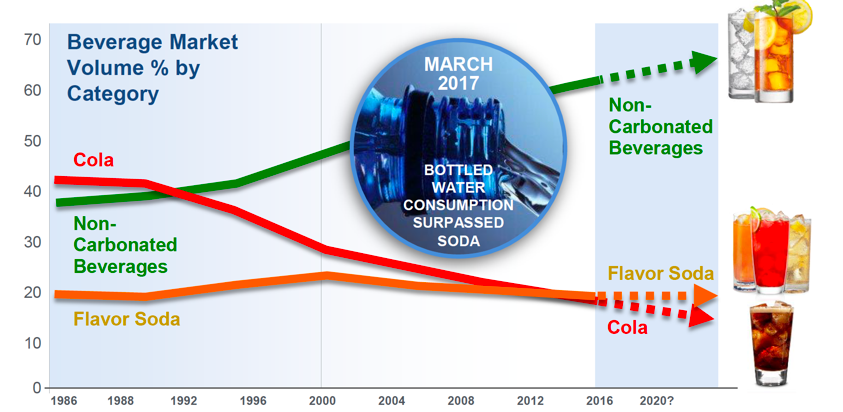

Bottled water volume passed carbonated soft drink share in 2017.

Both Coke and Pepsi have very large portfolios. They have this diversity of drinks because they know that betting only on cola makes no sense anymore.

It’s time for all of the industry to stop thinking of the cola wars. That thinking was valid in 1988. Today, we need to think about our beverage offering in a much broader way. And that means we need to think about our choice of a supplier in a way that has very little to do with a cola brand.

2. Affecting beverage incidence takes effort.

If you see statistics from a beverage company showing the aftermath of a switch that leads to a change in beverage incidence, it is not because of the cola brand (or any other brand). It’s because someone put a lot of effort into merchandising, crew incentives, and other initiatives that the drove the beverage incidence numbers.

Don’t fall into the trap of worrying about sales because you made a switch. It’s a false narrative devised by a beverage company to scare you into the status quo. And don’t buy that your switch will lead to incidence gains because of the brand. The data is clear that any movement in incidence is because of focused effort on the part of the restaurant chain. This was true back in the days when cola was the dominant beverage choice among consumers, and it is even more true today.

#2: I Need Dr. Pepper.

No. You probably don’t. Even if you are in Texas (but Texas is the only place in the world you could reasonably argue that you need it). Yes, it has a relatively good market share (although its market share in most of the USA, especially the Northeast, is really small). But, if you don’t get a good deal from Dr. Pepper, then don’t serve it. Your beverage sales will be just fine. Dr. Pepper offers no infrastructure, very little account management support, no service capabilities, very little imaginative marketing, no culinary support, and they actually compete with you.

Yes, they compete with you. The company that owns Dr. Pepper also owns Panera Bread, Einstein’s Bagels, Peet’s Coffee, and Pret A Manger. They are a major foodservice competitor of yours. Every time you buy a gallon of Dr. Pepper, you are fueling your competition’s profits and enabling them to compete with you for share of your target consumer’s foodservice expenditure.

#3: I’m in a Coke/Pepsi Geography, I Can’t Switch

Are you in Atlanta? Then no. Coke and Pepsi have virtually identical market share in the US and Canada. (Even if you are in Atlanta, you should remember that one of the most popular soft drink flavors in Georgia is a Pepsi product—Mountain Dew.)

Market share data is consistently manipulated by both soft drink companies. How many times have you seen one company say their market share is better than the other and then you hear the opposite from the other company in the next meeting? I hear that all the time. The reason is that anyone can make a case for anything by selecting the data that best makes their case.

Pepsi will sometimes use only convenience store data from certain periods of time to show their market share as higher. Coke sometimes will show only cola statistics to prove that Coke outsells Pepsi.

Ignore it all. Both Coke and Pepsi have wide portfolios and have roughly equivalent market share. The differences in market share mean nothing to your consumers or to your sales.

Other common but misguided fears . . .

#1: “I like my service levels now. What if they suffer after we switch? What if I don’t like my new rep?”

Good questions. Both of these concerns should be addressed during the negotiation of a new relationship. To do that, first, demand that the actual account team will be part of the negotiation process. That way you have the ability to form a relationship and evaluate their effectiveness.

Second, build penalties for poor performance into the contract. Penalties can range from cash to free product, and should be severe for repeated violations. Neither Coke nor Pepsi can claim freedom from poor service occasionally, so you aren’t at more risk with one than you are with the other.

#2: “I worry about the unknown. Everything’s working now. Why open ourselves up to potential pain for a few dollars when nothing is broken?”

Another good question. Don’t switch for a few dollars. Switch for a lot of dollars. There may be some short term work associated with it, but the rewards of saving a lot of money are worth it.

Equipment transition can be managed in such a way that there will be very little pain. If necessary, conversion can be at night. Most outlets require no more than a few hours to convert. New equipment should brighten your outlets and make service issues less common.

This is one of those “landmines” in your beverage contract that eventually needs to disappear. The unbundling charges are onerous, but by negotiating the right deal with the new supplier, the charges can be minimized and covered pretty easily.

#3: “I know most people won’t complain, but what about those vocal ones who can make my life miserable on social media?”

There will always be someone complaining about something on social media no matter what changes you make. A few complaints should not keep you from moving your business forward. Switching soft drink suppliers gives you a chance to talk about great new drinks and programming that your consumers will be interested in. And you can task your soft drink supplier with connecting with consumers on social media to talk about the plans for your partnership. The soft drink companies have armies of people working on social media platforms and are willing to extend their efforts to your brand.

What is true? Let’s examine some truths that get overlooked.

Truth #1: Your choice of a cola supplier should be based on price.

Rather, your choice should be based on rebates, since the fountain price is published (in the USA), and the only difference is what you negotiate back in rebates. Your sales will neither rise nor decline based on any switch of your supplier. If you want sales to go up, you must expend resources and effort to make it so. Your beverage supplier can help, but they can’t do anything without you and your team’s effort.

Both Coke and Pepsi have data that shows incidence increasing after switches to their brands. If you dig deep into what really happened, you will find that a well-coordinated effort caused those increases.

Basing your decision on price makes sense for several reasons. First and foremost, if you have the best deal, you are nearly certain to be at a competitive advantage. Second, cola is a small and diminishing part of your beverage mix. The whole portfolio is more important. Both Coke and Pepsi have large portfolios as a matter of necessity because of the declining importance of cola. So, using price as the differentiating factor makes sense. Finally, if you don’t focus on the financials, and use some other metric to make the decision, it is likely that you will find yourself paying too much.

Truth #2: Your Beverage Supplier Will Pack Your Contract with Landmines

Unless you identify contract landmines and negotiate them out, the suppliers will include them. Landmines are those clauses in the fine print, often stuck into the “standard terms and conditions,” that limit your ability to do what you need to do with beverages and funding. Trust me, there is nothing standard about the “standard terms.” Spend time up front on the contract language to avoid stepping on a landmine that will cause you grief in the future. If you’ve pre-determined which supplier will have your business based on the myths outlined above, you are giving up valuable leverage to uncover and dispose of unfavorable terms.

Truth #3: You Don’t Really Know if You Have a Good Deal

How would you know? Do you have hundreds of benchmarks to tell you so? Do you subscribe to a service that helps you gauge the relative worth of your beverage deal? Likely, your answer is “No” on both. Only Enliven has those benchmarks, and the subscription service to help you doesn’t exist like it does for beef, poultry, sugar, and other commodities.

Are you relying on your soft drink representative to tell you how good your deal is? Unfortunately, and obviously, that’s not a reliable source.

Are you relying on your knowledge of past deals that you have done? Soft drink deals get done once every five or seven or ten years. Things change rapidly. More importantly, how do you know that the last deal you did was good?

The truth is that no one knows their deal is good until they get a professional to analyze it and benchmark it. I have seen only one deal in all my years of doing this that really was as good as it could be. And even then, improvement in the contract language was still possible.

The Bottom Line

Most of what people think they know about what would happen if they changed suppliers is simply one (or more) of the myths perpetuated by the soft drink companies to keep you from switching. The truth is that what most people think they know, they simply don’t. As in the case of law, medicine, and so in the case of soft drink negotiations, it’s better to get professional help.

Want to learn more?

Watch our webinar re-play: “What Happens When You Switch Beverage Suppliers?”

Lead Photo by Letizia Bordoni on Unsplash